Wyckoff Analytics – Bruce Fraser & Roman Bogomazov – Point & Figure Charting

$750.00 $9.00

Total Sold: 2

Salepage: https://www.wyckoffanalytics.com/demand/point-and-figure-part-1/

Wyckoff Analytics – Bruce Fraser & Roman Bogomazov – Point & Figure Charting

Description

Wyckoff Analytics – Bruce Fraser & Roman Bogomazov – Point & Figure Charting

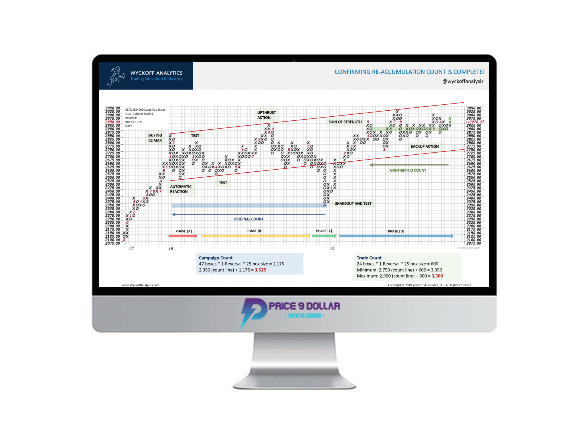

Legendary trader and educator Richard Wyckoff based his investment decisions primarily on analysis of market structure, supply and demand, and comparative strength. A final, critical component of Wyckoff’s trade selection and management was his unique method of using Point-and-Figure (P&F) charts both to identify realistic price targets and to improve timing of entries and exits. This technique works well for calculating reward-to-risk ratios and helping traders stay with a winning trade through normal corrections.

Legendary trader and educator Richard Wyckoff based his investment decisions primarily on analysis of market structure, supply and demand, and comparative strength. A final, critical component of Wyckoff’s trade selection and management was his unique method of using Point-and-Figure (P&F) charts both to identify realistic price targets and to improve timing of entries and exits. This technique works well for calculating reward-to-risk ratios and helping traders stay with a winning trade through normal corrections.

In Part I of this two-course series, Bruce Fraser and Roman Bogomazov cover the basics of using Point-and-Figure charts to calculate price targets using Wyckoff’s unique horizontal counting approach. Bruce and Roman present the materials as case studies that start with a blank P&F chart and then, as the chart unfolds over time, they show you their step-by-step process for taking and projecting horizontal counts.

Among Richard Wyckoff’s many contributions to technical analysis is his unique method of estimating price targets using his Second Law of “Cause and Effect,” in which the horizontal Point and Figure (P&F) count in any trading range represents the Cause and the subsequent trending price movement the Effect. Like many other phenomena in trading, Wyckoff’s Second Law is fractal, and can be profitably deployed in any time frame. In P&F Part II, Bruce Fraser and Roman Bogomazov provide detailed instructions on how to:

- Create and annotate Wyckoff-style P&F charts

- Correctly identify the count line in a variety of trading range configurations

- Designate P&F phases sequentially and project price targets from each

- Anticipate the resumption of a trend based on confirming counts of re-accumulation and re-distribution trading ranges

- Manage trades once price approaches P&F-based price targets

Wyckoff’s Law of Cause and Effect forms the foundation for his exceptional method of estimating price objectives using Point-and-Figure (P&F) charts. The underlying concept is deceptively simple, with the Cause equaling the horizontal P&F count in a trading range, which in turn generates an Effect or price target from the resulting trend. To obtain consistently reliable results with Wyckoff P&F charting, however, traders need a systematic approach, with guidelines that accommodate differences in trading range structures and timeframes.

We provided just such an approach, including some advanced and relatively new refinements, in our prior Point-and-Figure courses, which are among the most popular of all our on-demand courses. Point-and-Figure Part III, was developed in response to many student requests for additional applications of this remarkably versatile tool.

The course will include a review of some P&F fundamentals, followed by more advanced techniques. Although there is no prerequisite for Point-And-Figure Part III, we recommend that students also take Part I and Part II.

Salepage: Wyckoff Analytics – Bruce Fraser & Roman Bogomazov – Point & Figure Charting

Delivery Policy

When will I receive my course?

You will receive a link to download your course immediately or within 1 to 21 days. It depends on the product you buy, so please read the short description of the product carefully before making a purchase.

How is my course delivered?

We share courses through Google Drive, so once your order is complete, you'll receive an invitation to view the course in your email.

To avoid any delay in delivery, please provide a Google mail and enter your email address correctly in the Checkout Page.

In case you submit a wrong email address, please contact us to resend the course to the correct email.

How do I check status of my order?

Please log in to Price9Dollar account then go to Order Page. You will find all your orders includes number, date, status and total price.

If the status is Processing: Your course is being uploaded. Please be patient and wait for us to complete your order. If your order has multiple courses and one of them has not been updated with the download link, the status of the order is also Processing.

If the status is Completed: Your course is ready for immediate download. Click "VIEW" to view details and download the course.

Where can I find my course?

Once your order is complete, a link to download the course will automatically be sent to your email.

You can also get the download link by logging into your Price9Dollar account then going to Downloads Page.

Related products

Total sold: 3

![10k Portfolio In 2017 – Dan Sheridan [Special Offer] 1 10K PORTFOLIO IN 2017 – DAN SHERIDAN](https://price9dollar.net/wp-content/uploads/2021/09/s-x-100x100.png)